Linking Architecture to Environmental, Social Governance (ESG) Performance

What is ESG?

The acronym ‘ESG’ (Environmental, Social & Corporate Governance) is a term predominantly used in corporate organisations and the financial industry to better understand & judge the actions of business related to the general themes of;

Environment; Climate change, sustainability / sustainable development.

Social; Diversity and inclusion, human & animal rights, consumer protection.

Governance; Management structure, employee & executive compensation, employee relations.

A central aim of ESG is to create the ability for stakeholders of an organisation to review and critique the actions of business operations against the key central themes. The hope is that with this information to hand, society and institutional investors can be more ‘selective’ in deciding where the money flows, to not only generate a return on the investment but also to ensure that in generating this profit; climate change is not accelerated, rivers are not polluted, workforces not enslaved & social inequalities not exacerbated etc.

To me, what’s interesting about the subject is that it is in its infancy as a financial related protocol, with claims that ESG information can improve ‘alpha’ (improved return on investment), reduce financial risk and help solve societal problems. Equally there have been claims that it’s predominantly a greenwashing exercise, used to dilute the Environmental, Social & Governance related sins of ‘business as usual’.

First we’ll cover the basics of ESG - and then see how this ties into Architecture & Environmental Design. So please bear with - i feel like i’ve gone down the rabbit hole with this one..

Should we be skeptical of ESG?

The short answer is yes.

————————————————-

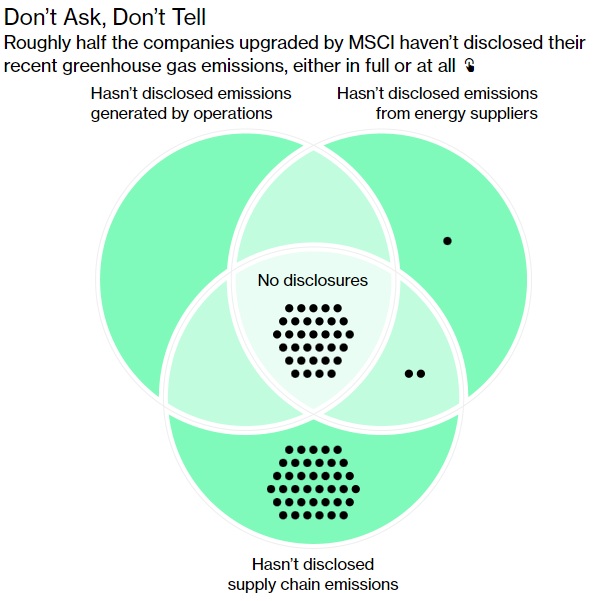

This is because the available rating methodologies used to examine ‘ESG performance’ are currently flawed, as a 2021 Bloomberg article, titled ‘The ESG Mirage’ reveals.

Feel free to use 12ft Ladder if you come across a website paywall.

The article examines MSCI Inc. which is a for profit company that creates & sells ‘indexes’ (performance ratings) using EGS related data. What’s concerning is that the rating methodology seems to currently examine the impact of ESG related issues on an organisation’s profitability and does not measure or rate the actual impact on the environment and society. This leads to some illogical outcomes, where MSCI can signal improved scoring in an ESG index; but a company can still increase carbon emissions, underpay employees & utilise tax havens.

A summary of the article below:

Ratings were improved for organisations predominantly through policy statements on corporate behaviour, with many achieving credit for confirming stances on issues which are already illegal, money laundering & bribery

Environmental factors have very little weight in the ratings; with the ‘water stress’ variable examining the availability of water for the company to use, not the impact of the company on the local water supply.

Carbon emissions and an organisations impact on climate change are insignificant variables in the rating methodology.

ESG rating providers use their own unique methodologies, which rely upon different information sources and self-reporting. The information disclosed is not audited or regulated, yet the investment terminology of ‘AAA’, ‘BBB’ etc. to ascertain ‘performance’, is still being used.

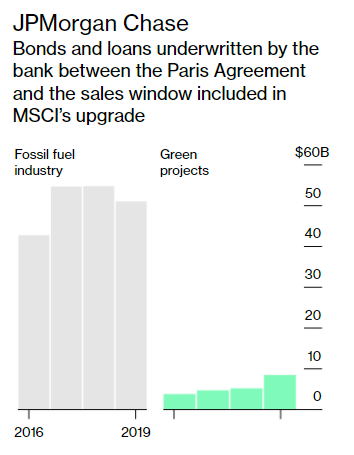

BlackRock’s iShares ESG Aware MSCI USA ETF (an investable fund claiming ESG performance) includes JPMorgan Chase & Co, who not only partook in the fraudulent sale of mortgage backed securities which led to the 2008 financial crisis, but also profits from loans and bonds issued the fossil fuel industry. The reason for its inclusion? increasing investment in ‘green projects’, even though these are still a fraction of the amount given to the fossil fuel companies who are responsible for climate change.

ESG + Real Estate = GRESB

GRESB stands for the Global Real Estate Environmental Sustainability Benchmark and is an important ESG rating mechanism for the Real Estate sector.

tbc.